Summer is almost here, and while the school doors may be closed, the opportunity for learning remains wide open! The Pathway to Financial Success program is dedicated to empowering students with essential financial literacy skills, and summer is the perfect time to elevate this initiative. Let’s dive into how we can support students during these sunny months and ensure they continue to build a brighter financial future.

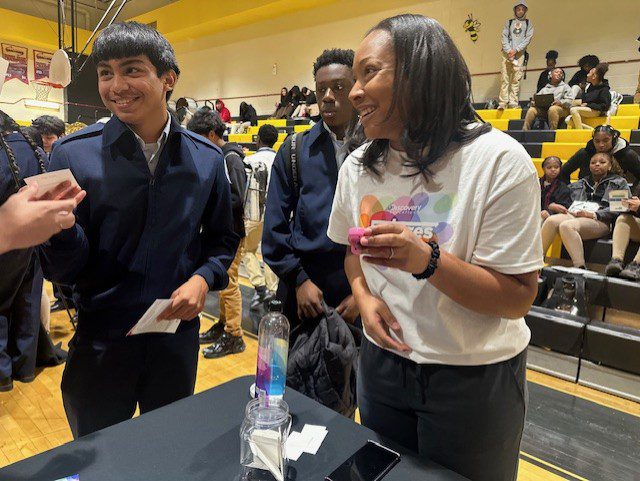

Pathway to Financial Success, supported by Discover Financial Services and Discovery Education, has been making a significant impact on financial literacy. The program is designed to bring financial education into classrooms across the country, providing funding for curriculum, materials, and teacher training. The goal is simple: equip students with the skills they need to succeed long after they leave the classroom.

Why Summer Learning Matters: Summer learning is crucial to prevent the “summer slide,” where students lose academic skills gained during the school year. By integrating financial education into summer activities, we can keep students engaged and help them retain valuable knowledge. Plus, it’s a fantastic way to make learning fun and relevant!

Strategies for Summer Learning

To keep students engaged and learning throughout the summer, it’s essential to incorporate fun and interactive financial education activities. Here are some effective strategies to ensure students continue to build their financial literacy skills during the summer months:

- Interactive Workshops: Host engaging workshops that combine financial education with hands-on activities. Think budgeting games, investment simulations, and money management challenges. These can be held at community centers, libraries, or even online.

- Reading Programs: Encourage students to explore books and resources on financial literacy. Partner with local libraries to create a summer reading list focused on money management, saving, and investing. Audiobooks and interactive e-books can also be great tools for learning on the go.

- Family Involvement: Get families involved by providing resources and activities they can do together. Create fun challenges like “Family Budgeting Week” or “Savings Goals Month” to foster a collaborative learning environment at home.

- Online Learning Platforms: Utilize online platforms like Khan Academy, Duolingo, or Scratch to offer courses and modules on financial topics. These platforms provide interactive and engaging content that can be accessed anytime, anywhere.

Support Teens This Summer with Financial Goals

Summer is a special time for teens as they embark on exciting adventures to test the waters on what it’s like to be independent and away from home. Here are a few resources that can help families support their teens this summer—from establishing good credit and strong savings to considering career options and life beyond high school!

Summer is a time for fun, growth, and learning. By integrating financial education into summer activities, we can help students stay engaged, retain valuable skills, and build a foundation for a successful financial future.

Let’s make this summer a season of empowerment with the Pathway to Financial Success program!